Malaysia Service Tax 2018

Malaysia’s Service Tax is a form of indirect tax imposed on any provision of taxable services made in the course or furtherance of any business by a taxable person in Malaysia. Service tax is not chargeable on imported services and exported services.

In general, the services provider is liable to be registered under the Service Tax Act 2018 when the value of taxable services provided for a period of 12 months that exceeds a threshold of RM500,000. The SST registration threshold is RM1,500,000 for Operator of restaurant, bar, snack-bar, canteen, coffee house or any place which provides food and drinks (eat-in or take-away , exclude canteen in an educational institution or operated by a religious institution or body), Caterer and Food court operator.

Refer to the Service Tax Threshold Table for more information.

The Service Tax rate is fixed at 6%. A specific rate of tax of RM25 is imposed upon issuance of principal or supplementary card and every subsequent year or part thereof.

The following taxable services are subject to the service tax:

- Hotel (include lodging house, service apartment, homestay, Inn, rest house, boarding house)

- Insurance and Takaful

- Service of food and beverage preparation (include restaurant, cafe, catering, take-away, food truck, retail outlet, hawkers and etc)

- Club (include Night club, private club, golf club)

- Gaming (include Casino, game of chance, sweepstakes, gaming machines, lottery, betting)

- Telecommunication

- Pay-TV

- Forwarding agents

- Legal

- Accounting

- Surveying

- Architectural

- Valuer

- Engineering

- Employment agency

- Security

- Management services

- Parking

- Motor vehicle service or repair

- Courier

- Hire and drive car

- Advertising

- Domestic flight except Rural Air Services

- Credit or charge card

- IT services

- Electricity

However, the service tax cannot be levied on any services that are not in the list of taxable service.

Accounting Basis for Service Tax

Companies shall prepare their SST return in payment basis for Service Tax purposes. Service Tax required to be accounted for at the time when the payments are received or on the day following period of twelve months when any whole or part of the payment is not received from the date of the invoice for the taxable service provided.

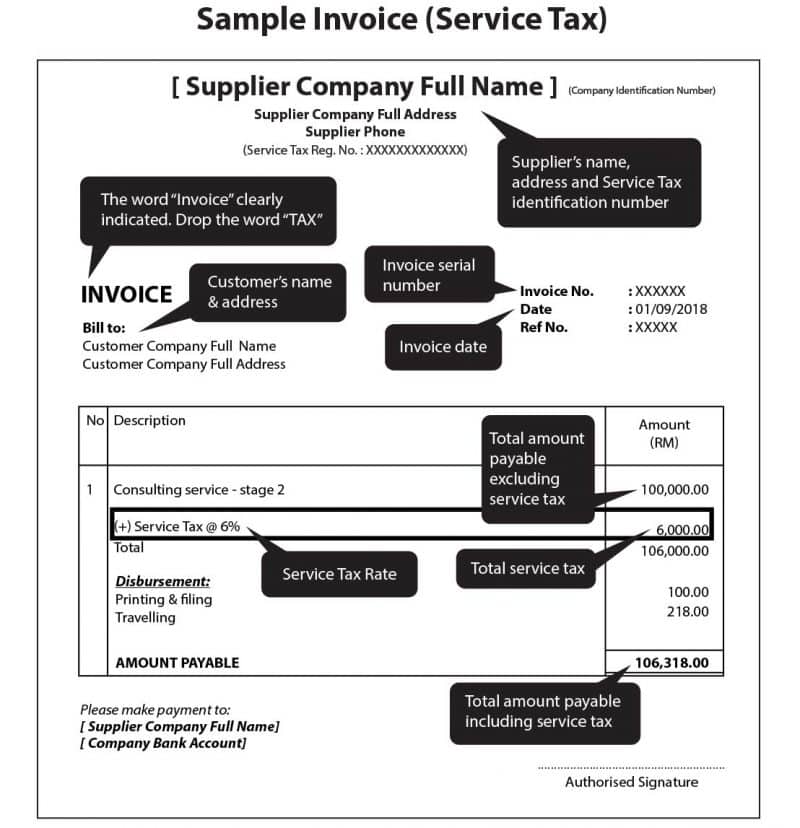

Companies who provide taxable services must issue invoices containing the prescribed particulars. The invoices can be in hardcopy or electronically, Bahasa Melayu or English. Any credit notes and debit notes issued shall make an adjustment in SST return.

Bad debts can be claimed by a registered person or a Ceased to be registered person. The bad debts can be claim after 6 months to 6 years from the date of service tax was paid and subject to condition and satisfaction of the DG. For bad debts recovered from the debtor after bad debts claimed and received the service tax refund, the registered person must repay the service tax refund to DG in his return.

The businesses must keep its records in Malaysia for 7 years. It is subjected to the DG approval for record keeping at overseas. The record can be kept in softcopy or hardcopy.

Sample Invoice for Service Tax